Insured Refund Program

The Insured Refund Program is an innovative group term life insurance policy marketed exclusively through Optimal Capital Group Insurance Services for Continuing Care Retirement Communities ("CCRCs"). This Term Life Insurance provides CCRCs with an alternative option to their current refund programs. With CCRCs as the group policy owner, individual certificates of coverage will be issued to the residents of these CCRCs who meet the eligibility requirements and purchase coverage levels of their choice (30-90% refund levels). Such residents choose a beneficiary of their Term Life Insurance. This Term Life Insurance product may increase the financial security of CCRCs and their residents by eliminating the ongoing need for a CCRC refund program funded by future residents' entrance fees, and it provides new Life Care residents an opportunity to purchase life insurance from an A+ superior A.M. Best rated company. This Term Life Insurance provides residents with a tax-beneficial way to leave a death benefit to the beneficiary of their choice - life insurance proceeds are not subject to income tax and can be structured to avoid probate as long as the named beneficiary is not the Insured's estate. The program is currently being offered to residents up to age 85 with single and joint life options available while premium varies by amount of coverage, gender, age, and single/join life.

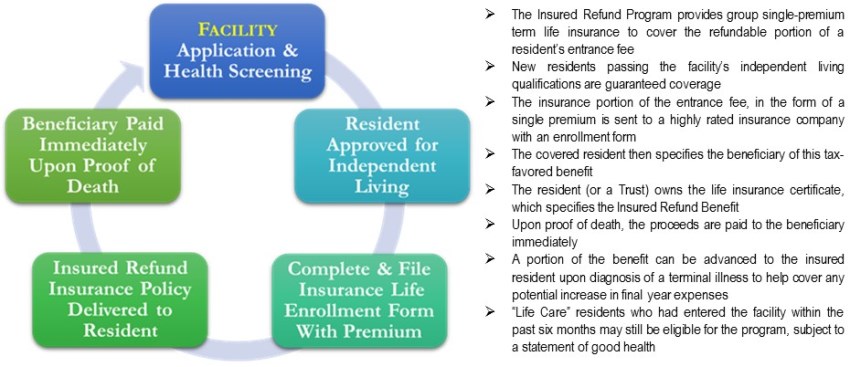

How It Works

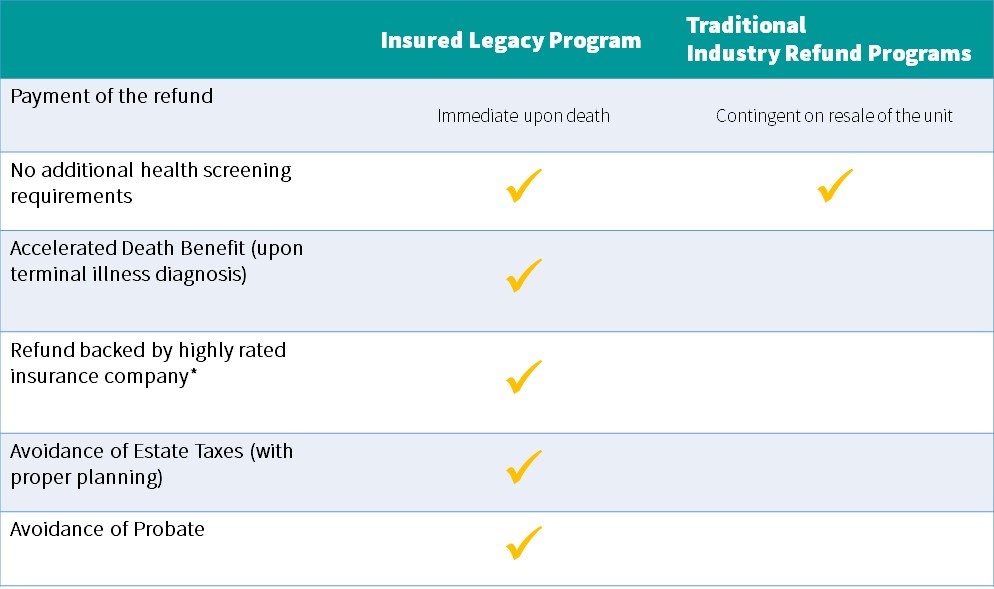

Advantages Over Traditional Refund Programs

What Does This Mean for the Community?

P Removal of entrance fee repayment

liability

P Marketing advantage for

participating communities

P Attraction of younger residents to

the community based on age-rated refunds

P Community retains the full value of the resold

unit with no obligation to pay off an existing

refund

What Does This Mean for the Resident?

P Immediate payment of the refund

P Entrance process remains the same -

no additional health screening to receive

insurance

P Additional help in the financing of

final year expenses for terminally ill residents

P Sense of security in a guaranteed

refund backed by an insurance company and not

subject to a community's financial strength

P Avoidance of additional burden for

children, grandchildren, and other beneficiaries

- no estate taxes or probate if set up properly

P Many options of refund levels at

different price points, giving residents more

purchasing flexibility